Vox has an interesting article on Elizabeth Warren’s newest economic reform proposal. Briefly, she wants to force corporations with more than $1 billion in revenue to apply for a charter of corporate citizenship.

This charter would make three far-reaching changes to how large companies do business. First, it would require businesses to consider customers, employees, and the community – instead of only its shareholders – when making decisions. Second, it would require that 40% of the seats on the board go to workers. Third, it would require 75% of shareholders and board members to authorize any corporate political activity.

(There’s also some minor corporate governance stuff around limiting the ability of CEOs to sell their stock which I think is an idea that everyone should be strongly behind, although I’d bet many CEOs might beg to differ.)

Vox characterizes this as Warren’s plan to “save capitalism”. The idea is that it would force companies to do more to look out for their workers and less to cater to short term profit maximization for Wall Street1. Vox suggests that it would also result in a loss of about 25% of the value of the American stock market, which they characterize as no problem for the “vast majority” of people who rely on work, rather than the stock market, for income (more on that later).

Other supposed benefits of this plan include greater corporate respect for the environment, more innovation, less corporate political meddling, and a greater say for workers in their jobs. The whole 25% decrease in the value of the stock market can also be spun as a good thing, depending on your opinions on wealth destruction and wealth inequality.

I think Vox was too uncritical in its praise of Warren’s new plan. There are some good aspects of it – it’s not a uniformly terrible piece of legislation – but I think once of a full accounting of the bad, the good, and the ugly is undertaken, it becomes obvious that it’s really good that this plan will never pass congress.

The Bad

I can see one way how this plan might affect normal workers – decreased purchasing power.

As I’ve previously explained when talking about trade, many countries will sell goods to America without expecting any goods in return. Instead, they take the American dollars they get from the sale and invest them right back in America. Colloquially, we call this the “trade deficit”, but it really isn’t a deficit at all. It’s (for many people) a really sweet deal.

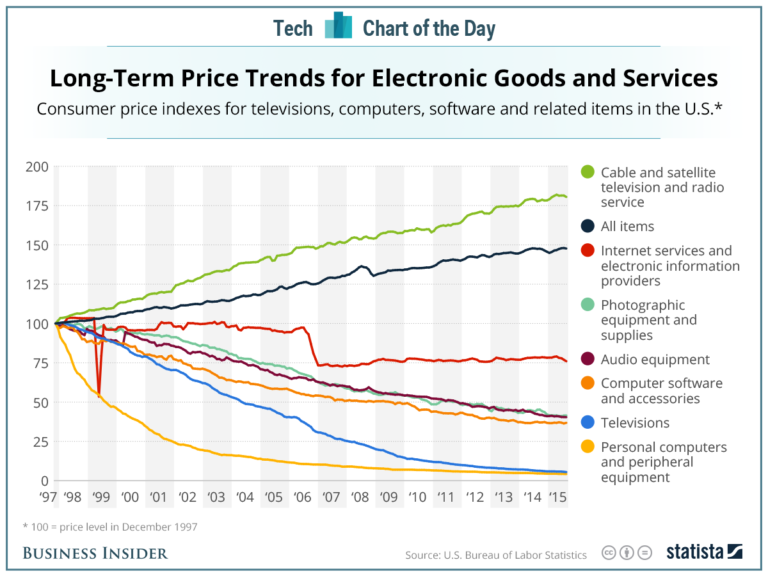

Anything that makes American finance more profitable (like say a corporate tax cut) is liable to increase this effect, with the long-run consequence of making the US dollar more valuable and imports cheaper2.

It’s these cheap imports that have enabled the incredibly wealthy North American lifestyle3. Spend some time visiting middle class and wealthy people in Europe and you’ll quickly realize that everything is smaller and cheaper there. Wealthy Europeans own cars, houses, kitchen appliances and TVs that are all much more modest than what even middle class North Americans are used to.

Weakening shareholder rights and slashing the value of the stock market would make the American financial market generally less attractive. This would (especially if combined with Trump or Sanders style tariffs) lead to increased domestic inflation in the United States – inflation that would specifically target goods that have been getting cheaper as long as anyone can remember.

This is hard to talk about to Warren supporters as a downside, because many of them believe that we need to learn to make do with less – a position that is most common among a progressive class that conspicuously consumes experiences, not material goods4. Suffice to say that many North Americans still derive pleasure and self-worth from the consumer goods they acquire and that making these goods more expensive is likely to cause a politically expensive backlash, of the sort that America has recently become acquainted with and progressive America terrified of.

(There’s of course also the fact that making appliances and cars more expensive would be devastating to anyone experiencing poverty in America.)

Inflation, when used for purposes like this one, is considered an implicit tax by economists. It’s a way for the government to take money from people without the accountability (read: losing re-election) that often comes with tax hikes. Therefore, it is disingenuous to claim that this plan is free, or involves no new taxes. The taxes are hidden, is all.

There are two other problems I see straight away with this plan.

The first is that it will probably have no real impact on how corporations contribute to the political process.

The Vox article echoes a common progressive complaint, that corporate contributions to politics are based on CEO class solidarity, made solely for the benefit of the moneyed elites. I think this model is inaccurate.

It is certainly true that very wealthy individuals contribute to political campaigns in the hopes that this will lead to less taxes for them. But this isn’t really how corporations contribute. I’ve written in detail about this before, but corporations normally focus their political contributions to create opportunities for rent-seeking – that is to say, trying to get the government to give them an unfair advantage they can take all the way to the bank.

From a shareholder value model, this makes sense. Lower corporate tax rates might benefit a company, but they really benefit all companies equally. They aren’t going to do much to increase the value of any one stock relative to any other (so CEOs can’t make claims of “beating the market”). Anti-competitive laws, implicit subsidies, or even blatant government aid, on the other hand, are highly localized to specific companies (and so make the CEO look good when profits increase).

When subsidies are impossible, companies can still try and stymie legislation that would hurt their business.

This was the goal of the infamous Lawyers In Cages ad. It was run by an alliance of fast food chains and meat producers, with the goal of drying up donations to the SPCA, which had been running very successful advocacy campaigns that threatened to lead to improved animal cruelty laws, laws that would probably be used against the incredibly inhumane practice of factory farming and thereby hurt industry profits.

Here’s the thing: if you’re one of the worker representatives on the board at one of these companies, you’re probably going to approve political spending that is all about protecting the company.

The market can be a rough place and when companies get squeezed, workers do suffer. If the CEO tells you that doing some political spending will land you allies in congress who will pass laws that will protect your job and increase your paycheck, are you really going to be against it5?

The ugly fact is that when it comes to rent-seeking and regulation, the goals of employees are often aligned with the goals of employers. This obviously isn’t true when the laws are about the employees (think minimum wage), but I think this isn’t what companies are breaking the bank lobbying for.

The second problem is that having managers with divided goals tends to go poorly for everyone who isn’t the managers.

Being upper management in a company is a position that provides great temptations. You have access to lots of money and you don’t have that many people looking over your shoulder. A relentless focus on profit does have some negative consequences, but it also keeps your managers on task. Profit represents an easy way to hold a yardstick to management performance. When profit is low, you can infer that your managers are either incompetent, or corrupt. Then you can fire them and get better ones.

Writing in Filthy Lucre, leftist academic Joseph Heath explains how the sort of socially-conscious enterprise Warren envisions has failed before:

The problem with organizations that are owned by multiple interest groups (or “principals”) is that they are often less effective at imposing discipline upon managers, and so suffer from higher agency costs. In particular, managers perform best when given a single task, along with a single criterion for the measurement of success. Anything more complicated makes accountability extremely difficult. A manager told to achieve several conflicting objectives can easily explain away the failure to meet one as a consequence of having pursued some other. This makes it impossible for the principals to lay down any unambiguous performance criteria for the evaluation of management, which in turn leads to very serious agency problems.

In the decades immediately following the Second World War, many firms in Western Europe were either nationalized or created under state ownership, not because of natural monopoly or market failure in the private sector, but out of a desire on the part of governments to have these enterprises serve the broader public interest… The reason that the state was involved in these sectors followed primarily from the thought that, while privately owned firms pursued strictly private interests, public ownership would be able to ensure that these enterprises served the public interest. Thus managers in these firms were instructed not just to provide a reasonable return on the capital invested, but to pursue other, “social” objectives, such as maintaining employment or promoting regional development.

But something strange happened on the road to democratic socialism. Not only did many of these corporations fail to promote the public interest in any meaningful way, many of them did a worse job than regulated firms in the private sector. In France, state oil companies freely speculated against the national currency, refused to suspend deliveries to foreign customers in times of shortage, and engaged in predatory pricing. In the United States, state-owned firms have been among the most vociferous opponents of enhanced pollution controls, and state-owned nuclear reactors are among the least safe. Of course, these are rather dramatic examples. The more common problem was simply that these companies lost staggering amounts of money. The losses were enough, in several cases, to push states like France to the brink of insolvency, and to prompt currency devaluations. The reason that so much money was lost has a lot to do with a lack of accountability.

Heath goes on to explain that basically all governments were forced to abandon these extra goals long before the privatizations on the ’80s. Centre-left or centre-right, no government could tolerate the shit-show that companies with competing goals became.

This is the kind of thing Warren’s plan would bring back. We’d once again be facing managers with split priorities who would plow money into vanity projects, office politics, and their own compensation while using the difficulty of meeting all of the goals in Warren’s charter as a reason to escape shareholder lawsuits. It’s possible that this cover for incompetence could, in the long run, damage stock prices much more than any other change presented in the plan.

I also have two minor quibbles that I believe are adequately covered elsewhere, but that I want to include for completeness. First, I think this plan is inefficient at controlling executive pay compared to bracketed scaled payroll taxes. Second, if share buybacks were just a short-term profit scheme, they would always backfire. If they’re being done, it’s probably for rational reasons.

The Good

The shift in comparative advantage that this plan would precipitate within the American economy won’t come without benefits. Just as Trump’s corporate tax cut makes American finance relatively more appealing and will likely lead to increased manufacturing job losses, a reduction in deeply discounted goods from China will likely lead to job losses in finance and job gains in manufacturing.

This would necessarily have some effect on income inequality in the United States, entirely separate from the large effect on wealth inequality that any reduction in the stock market would spur. You see, finance jobs tend to be very highly paid and go to people with relatively high levels of education (the sorts of people who probably could go do something else if their sector sees problems). Manufacturing jobs, on the other hand, pay decently well and tend to go to people with much less education (and also with correspondingly fewer options).

This all shakes out to an increase in middle class wages and a decrease in the wages of the already rich6.

(Isn’t it amusing that Warren is the only US politician with a credible plan to bring back manufacturing jobs, but doesn’t know to advertise it as such?)

As I mentioned above, we would also see fewer attacks on labour laws and organized labour spearheaded by companies. I’ll include this as a positive, although I wonder if these attacks would really stop if deprived of corporate money. I suspect that the owners of corporations would keep them up themselves.

I must also point out that Warren’s plan would certainly be helpful when it comes to environmental protection. Having environmental protection responsibilities laid out as just as important as fiduciary duty would probably make it easy for private citizens and pressure groups to take enforcement of environmental rules into their own hands via the courts, even when their state EPA is slow out of the gate. This would be a real boon to environmental groups in conservative states and probably bring some amount of uniformity to environmental protection efforts.

The Ugly

Everyone always forgets the pensions.

The 30 largest public pensions in the United States have, according to Wikipedia, a combined value of almost $3 trillion, an amount equivalent to almost 4% of all outstanding stocks in the world or 10% of the outstanding stocks in America.

Looking at the expected yields on these funds makes it pretty clear that they’re invested in the stock market (or something similarly risky7). You don’t get 7.5% yearly yields from buying Treasury Bills.

Assuming the 25% decrease in nominal value given in the article is true (I suspect the change in real value would be higher), Warren’s plan would create a pension shortfall of $750 billion – or about 18% of the current US Federal Budget. And that’s just the hit to the 30 largest public-sector pensions. Throw in private sector pensions and smaller pensions and it isn’t an exaggeration to say that this plan could cost pensions more than a trillion dollars.

This shortfall needs to be made up somehow – either delayed retirement, taxpayer bailouts, or cuts to benefits. Any of these will be expensive, unpopular, and easy to track back to Warren’s proposal.

Furthermore, these plans are already in trouble. I calculated the average funding ratio at 78%, meaning that there’s already 22% less money in these pensions than there needs to be to pay out benefits. A 25% haircut would bring the pensions down to about 60% funded. We aren’t talking a small or unnoticeable potential cut to benefits here. Warren’s plan requires ordinary people relying on their pensions to suffer, or it requires a large taxpayer outlay (which, you might remember, it is supposed to avoid).

This isn’t even getting into the dreadfully underfunded world of municipal pensions, which are appallingly managed and chronically underfunded. If there’s a massive unfunded liability in state pensions caused by federal action, you can bet that the Feds will leave it to the states to sort it out.

And if the states sort it out rather than ignoring it, you can bet that one of the first things they’ll do is cut transfers to municipalities to compensate.

This seems to be how budget cuts always go. It’s unpopular to cut any specific program, so instead you cut your transfers to other layers of governments. You get lauded for balancing the books and they get to decide what to cut. The federal government does this to states, states do it to cities, and cities… cities are on their own.

In a worst-case scenario, Warren’s plan could create unfunded pension liabilities that states feel compelled to plug, paid for by shafting the cities. Cities will then face a double whammy: their own pension liabilities will put them in a deep hole. A drastic reduction in state funding will bury them. City pensions will be wiped out and many cities will go bankrupt. Essential services, like fire-fighting, may be impossible to provide. It would be a disaster.

The best-case scenario, of course, is just that a bunch of retirees see a huge chunk of their income disappear.

It is easy to hate on shareholder protection when you think it only benefits the rich. But that just isn’t the case. It also benefits anyone with a pension. Your pension, possibly underfunded and a bit terrified of that fact, is one of the actors pushing CEOs to make as much money as possible. It has to if you’re to retire someday.

Vox is ultimately wrong about how affected ordinary people are when the stock market declines and because of this, their enthusiasm for this plan is deeply misplaced.

-

To some extent, Warren’s plan starts out much less appeal if you (like me) don’t have “Wall Street is too focused on the short term” as a foundational assumption.

I am very skeptical of claims that Wall Street is too short-term focused. Matt Levine gives an excellent run-down of why you should be skeptical as well. The very brief version is that complaints about short-termism normally come from CEOs and it’s maybe a bad idea to agree with them when they claim that everything will be fine if we monitor them less. ↩ -

I’d love to show this in chart form, but in real life the American dollar is also influenced by things like nuclear war worries and trade war realities. Any increase in the value of the USD caused by the GOP tax cut has been drowned out by these other factors. ↩

-

Canada benefits from a similar effect, because we also have a very good financial system with strong property rights and low corporate taxes. ↩

-

They also tend to leave international flights out of lists of things that we need to stop if we’re going to handle climate change, but that’s a rant for another day. ↩

-

I largely think that Marxist style class solidarity is a pleasant fiction. To take just one example, someone working a minimum wage grocery store job is just as much a member of the “working class” as a dairy farmer. But when it comes to supply management, a policy that restriction competition and artificially increases the prices of eggs and dairy, these two individuals have vastly different interests. Many issues are about distribution of resources, prestige, or respect within a class and these issues make reasoning that assumes class solidarity likely to fail. ↩

-

These goals could, of course, be accomplished with tax policy, but this is America we’re talking about. You can never get the effect you want in America simply by legislating for it. Instead you need to set up a Rube Goldberg machine and pray for the best. ↩

-

Any decline in stocks should cause a similar decline in return on bonds over the long term, because bond yields fall when stocks fall. There’s a set amount of money out there being invested. When one investment becomes unavailable or less attractive, similarly investments are substituted. If the first investment is big enough, this creates an excess of demand, which allows the seller to get better terms. ↩