I watch a lot of political debates with my friends. A couple of them have turned to me after watching heated arguments about public debt and (because I have a well-known habit of reading monetary policy blogs) asked me who is right. I hear questions like:

Is it true that public debt represents an unfair burden on our hypothetical grandchildren? Is all this talk about fiscal discipline and balanced budgets pointless? Is it really bad when public debt gets over 100% of a country’s GDP? How can the threat of defaulting on loans lead to inflation and ruin?

And what does all this mean for Ontario? Is Doug Ford right about the deficit?

This is my attempt to sort this all out in a public and durable form. Now when I’ve taken a political debate drinking game too far, I’ll still be able to point people towards the answers to their questions.

(Disclaimer: I’m not an economist. Despite the research I did for it and the care with which I edited, this post may contain errors, oversimplifications, or misunderstandings.)

Is Public Debt A Burden On Future Generations?

Among politicians of a certain stripe, it’s common to compare the budget of a country to the budget of a family. When a family is budgeting, any shortfall must be paid for via loans. Left unspoken is the fact that many families find themselves in a rather large amount of debt early on – because they need a mortgage to buy their dwelling. The only way a family can ever get out of debt is by maintaining a monthly surplus until their mortgage is paid off, then being careful to avoid taking on too much new debt.

Becoming debt free is desirable to individuals for two reasons. First, it makes their retirement (feel) much more secure. Given that retirement generally means switching to a fixed income or living off savings, it can be impossible to pay off the principle of a debt after someone makes the decision to retire.

Second, parents often desire to leave something behind for their children. This is only possible if their assets outweigh their debts.

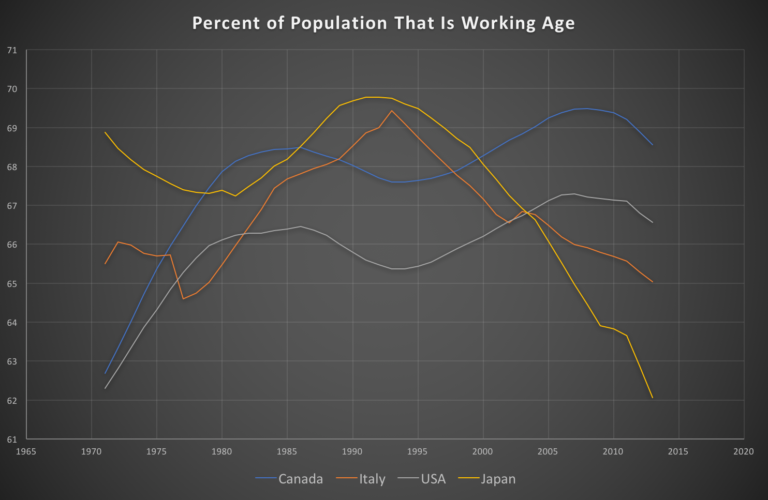

Countries have to grapple with neither of these responsibilities. While it is true that the average age in many countries is steadily increasing, countries that have relatively open immigration policies and are attractive to immigrants largely avoid this problem. Look at how Canada and the United States compare to Italy and Japan in working age population percentage, for example.

Even in Japan, where this is “dire”, the percentage of the population that is working age is equivalent to the percentage of the population that was working age in Canada or America in 1970. As lifespans increase, we may have to expand our definition of working age. But some combination of immigration, better support for parents, and better support for older citizens who wish to keep working will prevent us from ever getting to a point where it’s sensible to talk about a country “retiring”.

Since countries don’t “retire”, they don’t have to cope with the worry of “needing to work later to pay off that debt”. Since countries don’t have children, they don’t have to worry about having something to pass on. Countries don’t ever actually have to pay back all of their debt. They can continue to roll it over indefinitely, as long as someone is willing to continue to loan them money at a rate they’re willing to pay.

What I mean by “rolling over”, is that countries can just get a new loan for the same amount as their last one, as soon as the previous loan comes due. If interest rates have risen (either in general, or because the country is a greater risk) since their last loan, the new loan will be more expensive. If they’ve fallen, it will be cheaper. Rolling over loans changes the interest rate a country is paying, but doesn’t change the amount it owes.

Is Talk Of Discipline Pointless?

No.

Even if countries don’t really ever have to pay back the principle on their loans, they do have to make interest payments (borrowing to pay these is possible, but it isn’t a good look and can pretty quickly lead to dangerous levels of debt). The effect of these payments ranges from “it’s mildly annoying that we can’t spend that money on something better” to “we’re destroying our ecosystem growing bananas so that we have something to sell for cash to make our interest payments”. Lack of discipline and excessive debt levels can move a country closer to the second case.

In a well-integrated and otherwise successful economy with ample room in its governmental budget, interest payments are well worth the advantage of getting money early. When this money is used to create economic benefits that accrue faster than the interest payments, countries are net beneficiaries. If you take out a loan that charges 1-2% interest a year and use it to build a bridge that drives 4% economic growth for the next forty years, you’re ahead by 2-3% year on year. This is a good deal.

Unlike most talk about interest rates, where they’re entirely hypothetical, I really do mean that 1-2% figure. That’s actually higher than the average rate the US government has been paying to borrow over the last decade (Germany had it even better; they briefly paid negative interest rates). Governments – at least those with a relatively good track record around money – really have a superpower with how cheaply they can get money, so if nothing else, it’s worth keeping debt relatively low so that they don’t lose their reputation for responsibility and continue to have access to cheap money for when they really need it.

That’s the case in a moderately disciplined developed nation with adequate foreign reserves, at least. In a cash-poor or underdeveloped economy where a decent portion of any loan is lost to cronyism and waste, the case for loans being positive is much more… mixed. For these countries, discipline means “taking no loans at all”.

When discipline falls apart and debt levels rise too high, very bad things start to happen.

Is 100% of GDP The Line Beyond Which Debt Shouldn't Rise?

There is nothing special about 100% of GDP, except that people think it is special.

Sometimes, people talk about markets like they’re these big impersonal systems that have no human input. This feels true because the scale of the global financial system is such that from the perspective of pretty much any individual person, they’re impersonal and impossible to really influence. But ultimately, other than a few high frequency trading platforms, all decisions in a market have to be made by humans.

Humans have decided that in certain cases, it’s bad when a country has more than 100% of its GDP in debt. This means that it becomes much more expensive to get new loans (and because of the constant rollover, even old loans eventually become new loans) when a country crosses this Rubicon, which in turn makes them much more likely to default. There’s some element of self-fulfilling prophecy here!

(Obviously there does have to be some point where a country really is at risk from its debt load and obviously this needs to be scaled to country size and wealth to not be useless. I think people have chosen 100% of GDP more because it’s a nice round number and it’s simple to calculate, not because it has particularly great inherent predictive power, absent the power it has as a self-fulfilling prophecy. Maybe the “objectively correct” number is in fact 132.7% of the value of all exports, or 198% of 5-year average government revenues… In either case, we’ve kind of lost our chance; any number calculated now would be heavily biased by the crisis of confidence that can happen when debt reaches 100% of GDP.)

That said, comparing a country’s debt load to its GDP without making adjustments is a recipe for confusion. While Everyone was fretting about Greece having ~125% of its GDP in debt, Japan was carrying 238% of its GDP in debt.

There are two reasons that Japan’s debt is much less worrying than Greece’s.

First, there’s the issue of who’s holding that debt. A very large portion of Japanese debt is held by its own central bank. By my calculations (based off the most recent BOJ numbers), the Bank of Japan is holding approximately 44% of the Japanese government’s debt. Given that the Bank of Japan is an organ of the Japanese Government (albeit an arm’s length one), this debt is kind of owed by the government of Japan, to the government of Japan. When 44% of every loan payment might ultimately find its way back to you, your loan payments become less scary.

Second, there’s the issue of denomination. Greek public debts are denominated in Euros, a currency that Greece doesn’t control. If Greece wants €100, it must collect €100 in taxes from its citizens. Greece cannot just create Euros.

Japanese debt is denominated in Yen. Because Japan controls the yen, it has two options for repaying ¥100 of debt. It can collect ¥100 in taxes – representing ¥100 worth of valuable work. Or it can print ¥100. There are obvious consequences to printing money, namely inflation. But given that Japan has struggled with chronic deflation and has consistently underperformed the inflation targets economists think it needs to meet, it’s clear that a bit of inflation isn’t the worst thing that could happen to it.

When evaluating whether a debt burden is a problem, you should always consider the denomination of the debt, who the debtholders are, and how much inflation a country can tolerate. It is always worse to hold debt in a denomination that you don’t control. It’s always worse to owe money to people who aren’t you (especially people more powerful than you), and it’s always easier to answer debt with inflation when your economy needs more inflation anyways.

This also suggests that government debt is much more troubling when it’s held by a sub-national institution than by a national institution (with the exception of Europe, where even nations don’t individually control the currency). In this case, monetary policy options are normally off the table and there’s normally someone who’s able to force you to pay your debt, no matter what that does to your region.

Developing countries very rarely issue debt in their own currency, mainly because no one is interested in buying it. This, combined with low foreign cash reserves puts them at a much higher risk of failing to make scheduled debt payments – i.e. experiencing an actual default.

What Happens If A Country Defaults?

No two defaults are exactly alike, so the consequences vary. That said, there do tend to be two common features: austerity and inflation.

Austerity happens for a variety of reasons. Perhaps spending levels were predicated on access to credit. Without that access, they can’t be maintained. Or perhaps a higher body mandated it; see for example Germany (well, officially, the EU) mandating austerity in Greece, or Michigan mandating austerity in Detroit.

Inflation also occurs for a variety of reasons. Perhaps the government tries to fill a budgetary shortfall and avoid austerity by printing bills. This flood of money bids up prices, ruins savings and causes real wages to decline. Perhaps it becomes hard to convince foreigners to accept the local currency in exchange for goods, so anything imported becomes very expensive. When many goods are imported, this can lead to very rapid inflation. Perhaps people in general lose faith in money (and so it becomes nearly worthless), maybe in conjunction with the debt crisis expanding to the financial sector and banks subsequently failing. Most likely, it will be some combination of these three, as well as others I haven’t thought to mention.

During a default, it’s common to see standards of living plummet, life savings disappear, currency flight into foreign denominations, promptly followed by currency controls, which prohibit sending cash outside of the country. Currency controls make leaving the country virtually impossible and make any necessary imports a bureaucratic headache. This is fine when the imports in question are water slides, but very bad when they’re chemotherapy drugs or rice.

On the kind of bright side, defaults also tend to lead to mass unemployment, which gives countries experiencing them comparative advantage in any person intensive industry. Commonly people would say “wages are low, so manufacturing moves there”, but that isn’t quite how international trade works. It’s not so much low wages that basic manufacturing jobs go in search of, but a workforce that can’t do anything more productive and less labour intensive. This looks the same, but has the correlation flipped. In either case, this influx of manufacturing jobs can contain within it the seed of later recovery.

If a country has sound economic management (like Argentina did in 2001), a default isn’t the end of the world. It can negotiate a “haircut” of its loans, giving its creditors something less than the full amount, but more than nothing. It might even be able to borrow again in a few years, although the rates that it will have to offer will start out in credit card territory and only slowly recover towards auto-loan territory.

When these trends aren’t managed by competent leadership, or when the same leaders (or leadership culture) that got a country into a mess are allowed to continue, the recovery tends to be moribund and the crises continual. See, for example, how Greece has limped along, never really recovering over the past decade.

Where Does Ontario Fit In?

My own home province of Ontario is currently in the midst of an election and one candidate, Doug Ford, has made the ballooning public debt the centrepiece of his campaign. Evaluating his claims gives us a practical example of how to evaluate claims of this sort in general.

First, Ontario doesn’t control the currency that its debt is issued in, which is an immediate risk factor for serious debt problems. Ontario also isn’t dominant enough within Canada to dictate monetary policy to the Federal Government. Inflation for the sake of saving Ontario would doom any sitting Federal government in every other province, so we can’t expect any help from the central bank.

Debt relief from the Federal government is possible, but it couldn’t come without hooks attached. We’d definitely lose some of our budgetary authority, certainly face austerity, and even then, it might be too politically unpalatable to the rest of the country.

However, the sky is not currently falling. While debt rating services have lost some confidence in our willingness, if not our ability to get spending under control and our borrowing costs have consequently risen, we’re not yet into a vicious downwards spiral. Our debt is at a not actively unhealthy 39% of the GDP and the interest rate is a non-usurious 4%.

That said, it’s increased more quickly than the economy has grown over the past decade. Another decade going on like we currently are certainly would put us at risk of a vicious cycle of increased interest rates and crippling debt.

Doug Ford’s emotional appeals about mortgaging our grandchildren’s future are exaggerated and false. I’ve already explained how countries don’t work like families. But there is a more pragmatic concern here. If we don’t control our spending now, on our terms, someone else – be it lenders in a default or the federal government in a bailout – will do it for us.

Imagine the courts forcing Ontario to service its debt before paying for social services and schools. Imagine the debt eating up a full quarter of the budget, with costs rising every time a loan is rolled over. Imagine our public services cut to the bone and our government paralyzed without workers. Things would get bad and the people who most need a helping hand from the government would be hit the hardest.

I plan to take this threat seriously and vote for a party with a credible plan to balance our budget in the short term.

If one even exists. Contrary to his protestations, Doug Ford isn’t leading a party committed to reducing the deficit. He’s publically pledged himself to scrapping the carbon tax. Absent it, but present the rest of his platform, the deficit spending is going to continue (during a period of sustained growth, no less!). Doug Ford is either lying about what he’s going to cut, or he’s lying about ending the debt. That’s not a gamble I particularly want to play.

I do hope that someone campaigns on a fully costed plan to restore fiscal order to Ontario. Because we are currently on the path to looking a lot like Greece.